Oct. 21, 2022 (EIRNS)—The demise of Liz Truss after merely six weeks in office is not the end of Britain's problems, but merely the beginning. Britain’s HM Treasury announced it has earmarked £11 billion to be transferred to the Bank of England, to compensate for QE losses. The first tranche of several hundred millions has already taken place. Guess where those losses come from? Yes, from the interest rate hike decided by the Bank of England itself (because of rate hikes, bonds owned by the BOE today are worth less than when they were bought). Question: Why is the BOE not printing that money, as it has done so far? Answer: Because it is afraid to create inflation.

So, the next question: Where will the Treasury get the money from? It has only two options: either it borrows it—but then we have the absurdity that the BOE will buy that debt again—or it introduces new taxes. International financial media already speculate on the inevitability of the second choice. New taxes in an explosive social situation—speaking of turbulence is a euphemism.

The British financial crisis is threatening to unleash a collapse of the global financial system. Below we republish an article from EIR, originally published on Oct. 19, before the Truss resignation:

Chaos Hits British Markets and Government

It might be unfair to blame Liz Truss for everything, but the ‘British bond crisis,’ as it will be called, unleashed by her draft budget, has opened dangerous cracks not only among British pension funds and banks, but also on the U.S. bond market and among Swiss banks, just to mention the most visible cases (cf. below). Ultimately, British Prime Minister Truss lost her battle against the Bank of England, and was forced to fire her hapless Chancellor of the Exchequer and reverse her plan (tax increases instead of tax cuts). Extraordinary liquidity injections by the Bank of England have momentarily stopped the collapse of government bonds (gilts), but runaway inflation has not been tamed and liquidity crises are popping up in other sections of the global financial system.

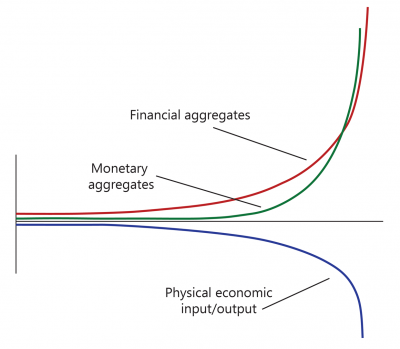

As we sum up here what happened, the reader must keep in mind that regardless of the contingent triggers of the crisis, the ultimate cause of the current, final crisis of the global financial system is the one identified long ago by Lyndon LaRouche: the creation of a pyramid of financial values decoupled from real physical productivity. Early on, LaRouche characterized the central banks’ pumping up of the financial bubble as ‘potentially hyperinflationary,’ but magicians like Alan Greenspan, Ben Bernanke, or Mario Draghi told you that liquidity was only being created in the realm of financial assets and would stay there, i.e., that the asset price inflation would never spill over into consumer price inflation…

LaRouche's Triple Curve function. As the physical economic productivity of the economy is driven downwards through such policies of underinvestment in infrastructure and green energy, the nominal value of financial aggregates increases, due to the financialization of the economy. To maintain the supposed value of these instruments, a growing monetary supply is required through bailouts and "quantitative easing."

But it did spill over—exactly as LaRouche had warned. Energy and commodity prices went up exponentially in spring of last year, as the capacity of the financial system to generate enough nominal profits was exhausted, and the immense liquidity which had pumped up the bubble stormed into energy, food and other commodity markets, magnifying the supply and demand imbalances. In the case of energy, the cuts in capacity generated under the ‘Green transition’ offered hedge and vulture funds a golden opportunity to drive prices sky high—well before the war in Ukraine.

After insisting for months that inflation was ‘transitory,’ central banks attempted to hit the brakes, by raising interest rates. Too late. The system had entered a ‘boundary condition’ (as defined by LaRouche) in which no conventional measures would work. It was close to ending up in either a hyperinflationary blowout, or a chain-reaction collapse.

And that is what we have seen in the British bond crisis: Liz Truss’s tax cut measures accelerated the drop in value of British gilts already set off by the interest rate hikes; that generated a wave of margin calls on the collateral deposited by pension funds; the Bank of England reacted by injecting £65 billion within a few days and opening short and long-term repo facilities for the banks. The storm abated only when Truss announced a 180 degree about-face in government policy. Many now expect 10 Downing Street to receive a new tenant very soon.

Despite the backtracking by the British government, yields on the gilt remain high, compared to pre-crisis levels (cf. above). Meanwhile, the crisis hitting them has expanded to U.S. corporate and government bonds. Indeed, to answer the margin calls, U.K. funds have sold those bonds, so much so that Biden’s Treasury Secretary Janet Yellen warned of a dangerous liquidity crisis on the U.S. bond market.

Another crisis broke out in Switzerland, where the Swiss National Bank had to double the dollar swap it had reached with the Federal Reserve, in order to meet a massive request for dollar loans by Swiss banks. While on Oct. 5, the SNB first requested $3.1 billion, one week later it had doubled that to $6.27 billion. The number of Swiss banks requesting dollars went from 9 to 15. "The doubling of the auctioned total is historic. Domestic institutions had long not borrowed so much money," wrote the Swiss financial site Inside Paradeplatz.

Such dollar swaps have been common since 2008, but now it is different. Whereas last year such loans cost 0.33%, they now cost 3.33% for a 7-day maturity.

Central banks are trying to apply the accelerator and put on the brakes at the same time. It will not work. The system is doomed and cannot be saved. The trans-Atlantic establishment is blind to reality, as is shown by the fact that the Nobel Prize in Economics 2022 was awarded to former Fed Chairman Ben Bernanke, who is the person most responsible for the current hyperinflationary wave. A bit like giving the Science award to Ptolemy for discovering that the Sun revolves around the Earth.

This insanity must stop. The system must be put through a bankruptcy-like reorganization, with the adoption of a Glass-Steagall reform to destroy the speculative sector, and the implementation of a credit system to finance a physical economic recovery.”