March 18—Feverish emergency meetings of financial authorities are underway on both sides of the Atlantic this weekend, as the owners of the thoroughly bankrupt trans-Atlantic financial system scramble to prevent their entire system from blowing out. The reason can be summed up in a single word: derivatives.

The imminent collapse of Credit Suisse, one of Switzerland’s most venerable banking institutions, founded 167 years ago in 1856, is causing at least as much panic across the entire trans-Atlantic financial sector as the March 10 bankruptcy of Silicon Valley Bank, and the imminent blowout of First Republic Bank, both of California. That’s because the collapse of Credit Suisse threatens to blow out the entire trans-Atlantic financial derivatives bubble.

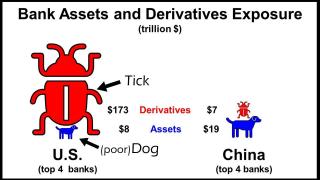

First, look at the big picture with derivatives. The top four American banks with derivatives exposure (as of the end of 2022) are:

JPMorgan Chase, with $54.3 trillion in derivatives, against $3.3 trillion in assets—a 16:1 ratio.

Goldman Sachs, with $51.0 trillion in derivatives, against $0.5 trillion in assets—a 99:1 ratio.

Citibank, with $46.0 trillion in derivatives, against $1.7 trillion in assets—a 27:1 ratio.

And Bank of America, with $21.6 trillion in derivatives, against $2.4 trillion in assets—a 9:1 ratio.

The top four U.S. banks hold a combined $173 trillion in derivatives exposure (89% of the total of all American banks), which stands in a 22:1 ratio to their combined assets of $7.9 trillion. (By contrast, China’s four largest banks have combined assets of $19 trillion, but their derivatives are estimated to be only some $7 trillion—a ratio of less than 0.4:1.)

This Western derivatives frenzy is why, when bank failures and debt defaults begin, the spreading bankruptcy effect is not like that of simple dominoes in a row, one knocking over the other. It is like a thermonuclear chain-reaction, but in finances, as Lyndon LaRouche frequently explained. In other words, the various forms of debt are simply the fuse; but it is the derivatives that are the bomb, whose explosive charge is more than an order of magnitude greater than the debt alone.

Now consider Credit Suisse (CS). The bank’s assets have fallen from $912 billion to $574 billion between the end of 2020 and the end of 2022 (a 38% plunge), but the bigger problem is CS’s derivatives exposure of about $16.1 trillion at the end of 2022. That may not sound like a prize-winning level, compared to JPMorgan’s $54.3 trillion, but CS’s ratio of derivatives exposure to assets is about 28:1—even greater than the average of 22 of the U.S.’s four top bank derivatives holders. And as with the entire $2 quadrillion world financial bubble, each part of the derivatives speculative bubble is inextricably intertwined with every other part.

The following commentary from Oct. 17, 2022 entitled “Is Your Bank Safe from a Credit Suisse Collapse?,” by the Wall Street community website Seeking Alpha, makes the point clearly:

“CS’s notional amount of derivatives is CHF15 trillion [$16.1 trillion], which is almost 70% of the total U.S. GDP. Yes, this is notional amount, and after netting it becomes much smaller. However, the majority of these derivatives are OTC (over the counter) contracts, which are the riskiest type of derivatives, especially in a recessionary environment when there is a high chance of a counterparty default risk. It is highly likely that CS is among derivative counterparties of large U.S. banks, and in a crisis scenario CS likely would not be able to meet its obligations under these OTC contracts. This would lead to major losses for U.S. banks, and eventually for their retail depositors. Bottom line: We believe derivatives exposure is one of the key risks for a bank in a volatile environment, since there is a high chance of a counterparty default risk.”

As the financial crisis ricochets back and forth across the Atlantic, the lords of the City of London and Wall Street have once again determined to bail themselves out to the tune of hundreds of billions of dollars taken from government budgets. These are funds that could—and should—be used for economic reconstruction and industrialization, to lifting hundreds of millions out of poverty as China has done, to doubling food production to feed a hungry planet, to investing in science to reach the stars. Instead, the wellbeing of millions is being gambled away and fed to the derivatives golem.

And war has been launched against any who—like China, Russia, and the emerging Global Majority—would get off this sinking Titanic and create a new international economic system based on physical-economic development.

This is why Schiller Institute founder Helga Zepp-LaRouche’s March 14 “Call for an International Emergency Conference To Reorganize the Bankrupt Financial System” is both the only viable approach to solving the economic breakdown crisis, and at the same time the best proposal on the table to bring about peace in Ukraine and across the planet. Please add your name to this urgent call.